Tips and Trends: Small Cell 5G Systems

June 5, 2019

The role of small cells is increasing with each “G”. The appetite for more data speeds and capacity is driven by consumers and businesses. These tiny base stations are the carriers’ go-to solution to ensure quality of service in the outer edge of the network is met. Today’s growth is also attributed to LTE-A Pro and 5G services. In this post, we provide the latest insights on the small cell market trends, RF front-end challenges and practical solutions to meet user and manufacturer needs.

The role of small cells is increasing with each “G”. The appetite for more data speeds and capacity is driven by consumers and businesses. These tiny base stations are the carriers’ go-to solution to ensure quality of service in the outer edge of the network is met. Today’s growth is also attributed to LTE-A Pro and 5G services. In this post, we provide the latest insights on the small cell market trends, RF front-end challenges and practical solutions to meet user and manufacturer needs.

Small Cells Market Update 2019

Small cell deployment has shifted toward large-scale densification, which increases capacity in operator networks across an array of locations and addresses rising consumer and enterprise mobile broadband needs. 5G will make the challenge of densification even more daunting due to the number of small cell deployments required to meet all 5G use cases effectively.

Catch up on the other blogs in this series:

In a Small Cells Forum market update, 78 global mobile operators were asked to list all their reasons to densify. The most significant drivers relate to increased capacity and costs.

- 40% of operators placed dense capacity to support enhanced quality of experience as a top reason, as this can affect churn reduction and customer satisfaction.

- 38% said reducing overall cost of capacity as the reason to invest in small cells.

Mobile network operators (MNOs) are looking to support higher levels of data usage and rising customer expectations of a high-quality experience. They must do this profitably while servicing many markets. Small cell densification helps achieve this goal while keeping cost of ownership at a manageable level.

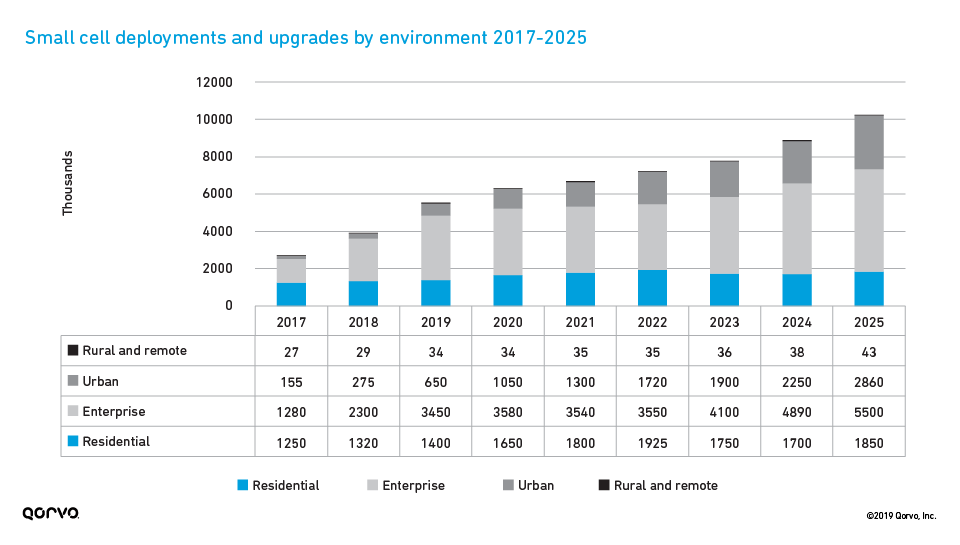

According to the Small Cells Forum, by 2025 small cell deployments and upgrades will reach 10.25 million radios, with 8.4 million being non-residential. Enterprise, at 5.5 million units will be the largest, followed by urban deployments. (see Figure 1)

Figure 1. (source: Small Cells Forum)

The 40% YoY growth from 2017 to 2019, can be attributed to the China market densification for capacity. For 2020 and beyond, the market maintains a steady 20% growth rate due to many enterprise use cases (i.e. manufacturing automation, IOT, shipping ports, etc.). Although the densification of small cells in North America has been slow, moving forward we will see an increase in deployments with the citizens band radio service (CBRS 3.5 GHz).

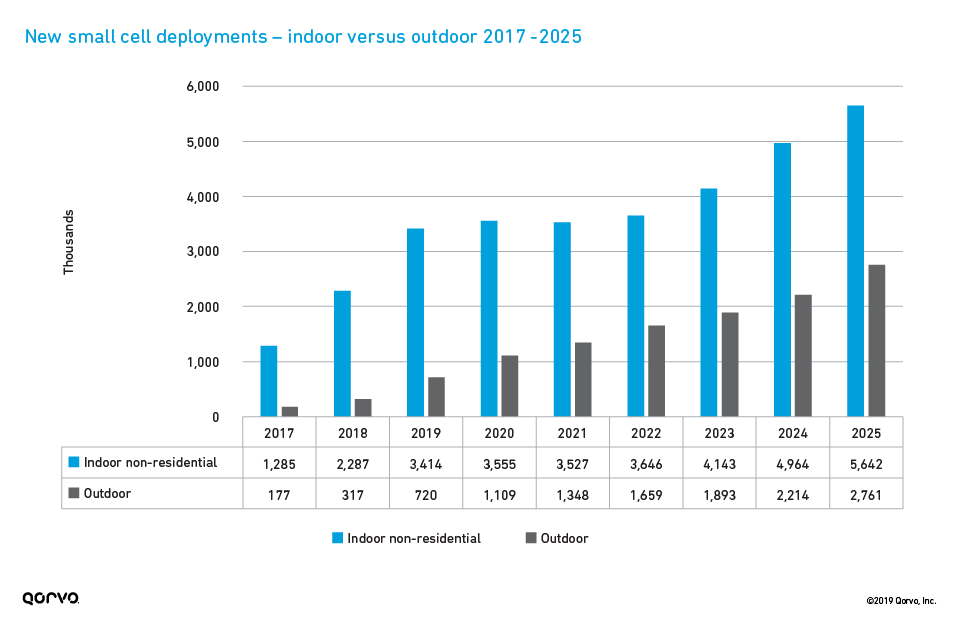

The majority of non-residential indoor small cells are public-facing in the enterprise environment supporting private enterprise activities. Outdoor small cells are servicing MNO public networks in urban, suburban or rural environments. Most of these indoor small cells are driven by 2.4 GHz and below frequencies, while the China market drives the outdoor small cell growth. In the 5G era, much of the small cell market growth will be related to industrial and Internet of Things services.

Figure 2. (source: Small Cells Forum)

Small Cells for 5G Networks

The intent of small cells is to alleviate the load on macro cells by augmenting the network capacity and provide extended coverage. Use of small cells is limited to dense areas and indoors (i.e. stadiums, shopping malls, etc.) where macro signal penetration is inadequate. To this effect, small cells have been hugely popular for 4G LTE coverage and capacity enhancement. Now, with the market transitioning to 5G, a whole new spectrum is opening with contiguous bandwidths of more than 100MHz available within the 2.6 to 5 GHz range. This additional spectrum will support high data rates and new market opportunities. Further, higher order multiple-input-multiple-output (MIMO) is the standard macro architecture, enabling higher throughput and data rates. Small cells will continue to play a pivotal role for 5G capacity enhancement with indoor coverage.

Traditionally small cells have been deployed in a 2-transmit/2-receive (2T/2R) MIMO configuration but with 5G, that architecture will be expanded to 4T/4R for increased throughput. These small cells are networked with 5G macro cells that use massive MIMO leveraging AAS (active antenna systems) in configurations of 32T/32R and 64T/64R. This maximizes spectral efficiency (more bits per Hz) for operators by providing the optimal balance between user coverage and capacity.

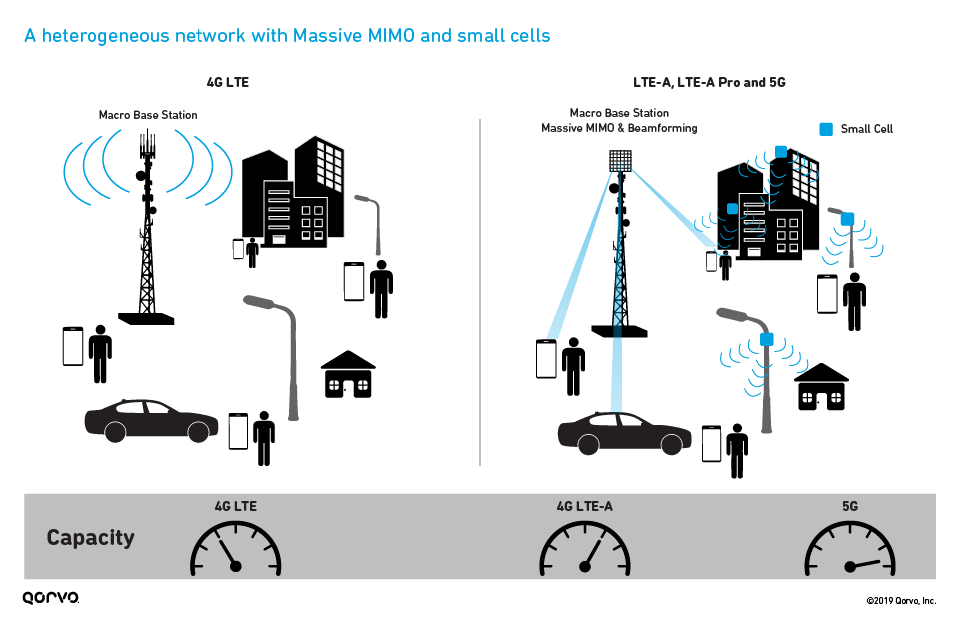

Massive MIMO has been an integral part of the network since the release of 4G LTE-A PRO and 5G standards (see Figure 3). For 5G, MNOs will be deploying small cells at a faster rate than previous generations as densification is top-of-mind.

Figure 3

As displayed in Figure 3, network capacity jumps with LTE-A due to massive MIMO and small cell integration. The capacity jumps even more with 5G. Beamforming and advanced antenna array architecture also helps reduce co-cell interference. This new architecture design increases bandwidth, provides a more focused energy, reduces interference and provides a capacity lift via small cells.

RF Front-End Design Challenges and Solutions

A typical small cell consists of radios for licensed cellular and LTE unlicensed (LTE-U) bands. Also, there is a push for IoT implementation in small cells at the edge of the network – for homes, businesses, and automobile communications.

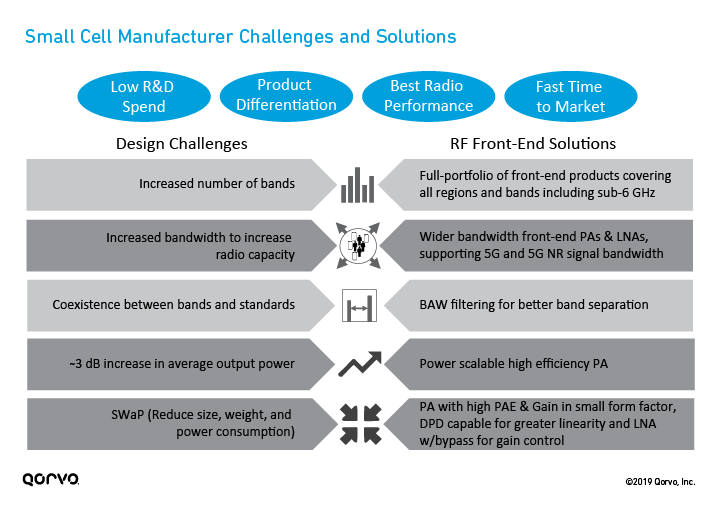

So, what challenges do manufacturers and suppliers face when developing small cell systems? Low capital expenditure, product differentiation, best-in-class performance, and fast time to market are some of the top challenges manufacturers face. They also face the biggest trade-off between spectrum addition vs. densification to boost capacity. Take a look at Figure 4 for a high-level view of how design challenges can be addressed with a variety of RF front-end solutions.

Figure 4

Increase in number of bands. Just like the mobile device has increased in complexity, the small cell must also become more multifaceted. There has also been an increase in the number of bands, now up to 52. Frequency bands are also moving above 3 GHz with new 5G NR bands such as n77, n78 and n79. The incorporation of additional bands in the small cell and the adoption of 4T4R MIMO radio configuration help enable carrier aggregation (CA) to further increase network capacity and data speed. Having a large portfolio of RF front-end components offering multi-band solutions from one source is optimal. This can decrease design time and vendor qualification for the small cell manufacturer.

Larger bandwidth requirements. As indicated earlier, the need for more spectrum is crucial for capacity expansion. Radio capacity must increase to meet the high data rate expectations for 5G. To meet the radio capacity in 5G, the small cell front-end will need to use wide bandwidth amplification, as narrow band devices will no longer suffice. Having an RF product portfolio encompassing both LTE-A PRO and 5G bands is important, as it provides design and stock keeping unit (SKU) flexibility for the small cell manufacturer. Additionally, providing wider bandwidth RF components helps meet increased bandwidth requirements with fewer discrete components, reducing design time and time to market.

Coexistence between bands and standards. Carriers must meet the capacity and data rate requirements for 4G LTE, 5G and unlicensed bands. Small cell manufacturers must design units that mitigate interference between all these bands and standards (i.e. LTE, 5G, Wi-Fi, etc.). These interferences can occur inside small cell units and around the unit. Using BAW filters is the best defense in mitigating interference, as these provide steep band edge skirts, are small in size and can meet high power requirements without damage.

Output powers are increasing. Recently there has been a push to increase average PA output power levels. Small cell manufacturers are requesting the higher RF PA output power levels to add design flexibility. This helps them scale the design to different market segments requiring better coverage vs. capacity. But, this requirement does add a level of complexity for PA designers, as they need to increase the PA output power while maintaining a high level of linearity and efficiency. Recently, PA output power requirements have risen approximately 3 dB. The increased power level limit raises the possibility of out-of-band distortion, making it difficult for manufacturers to meet spectral emissions mask requirements. Finding RF vendors with PA products that meet these high-power requirements helps reduce design time and can reduce components in the RF chain.

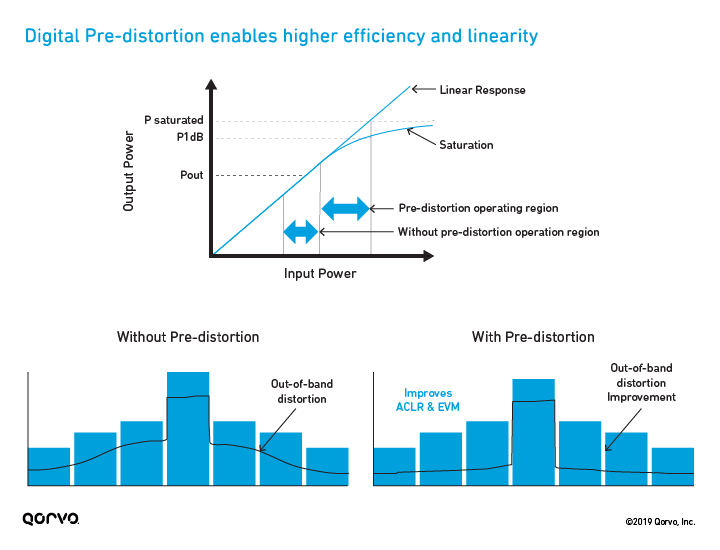

Figure 5

A PA is most efficient near saturation. However, as seen in Figure 5, near saturation a PA can generate out-of-band distortion components. Using a design technique known as digital pre-distortion (DPD) the PA can run nearer to saturation with out-of-band distortion minimized. DPD is a software-based design method for removing distortion using digital signal processing techniques. It allows a PA to be optimally designed for lower power dissipation but achieve similar output power and still maintain the required spectral mask requirements as a linear PA.

Get back to the basics on RF in this Second Edition 5G RF For Dummies

Download the E-Book

Download the E-Book

This technique has been around for several years and is widely used in wireless infrastructure applications. Many RF component suppliers offer both DPD and non-DPD components to allow small cell manufacturers design and SKU flexibility.

Size, weight and power consumption (SWaP) requires more efficient devices. As small cells become part of the landscape (i.e. on light posts, city benches, under manhole covers, etc.), smaller more highly efficient components are needed. As noted above, keeping distortion in check and linearity optimized helps attain higher output power and achieve SWaP.

Typically, small cell manufactures require a minimum of 35% power added efficiency (PAE) of the RF PA, as this offers low power consumption and low operating cost. Unit size is driven by end user placement, like a park bench or a sign post. To meet customer form factor expectations, RF component manufacturers must create more linear and power efficient devices. By doing so, they can meet the size restrictions, power output and the lower power consumption requirements.

Building the Future Together

There are many drivers for the small cell evolution including 5G densification rollouts. The small cell is becoming more multifaceted, integrating more bands, bandwidths, higher levels of linearity and efficiency to help MNOs attain much-needed ROI. Qorvo is helping guide small cell supply chain designers and carriers through this evolution by offering an extensive portfolio of PAs, LNAs, filters, diplexers, switches and front-end modules. For a complete listing of our small cell portfolio click here.

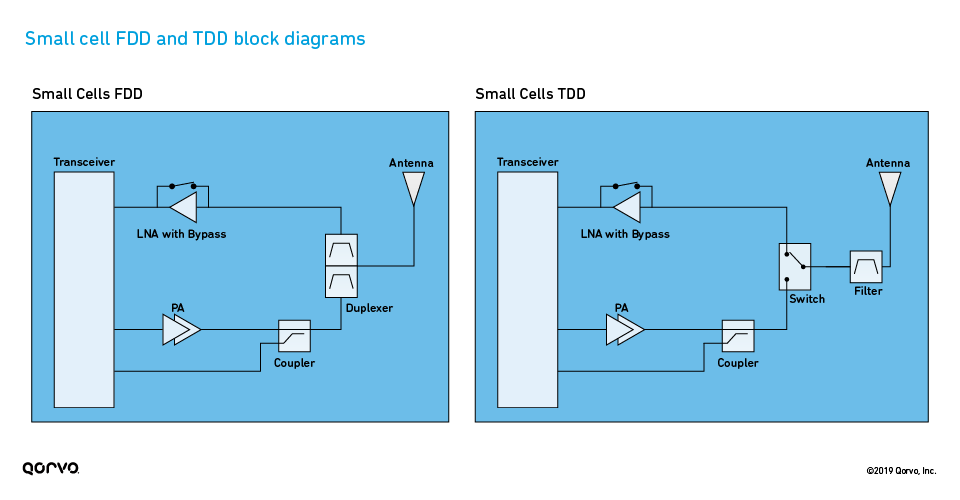

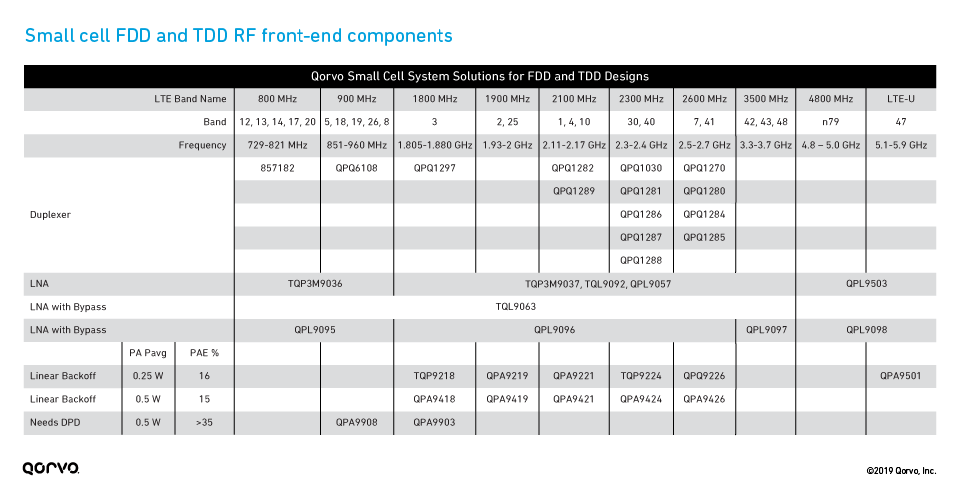

Below is a non-exhaustive list of Qorvo RF front-end components and block diagrams for FDD and TDD small cell applications.

Figure 6. Small cell FDD and TDD block diagrams

Table 1

Have another topic that you would like Qorvo experts to cover? Email your suggestions to the Qorvo Blog team and it could be featured in an upcoming post. Please include your contact information in the body of the email.